property tax rates philadelphia suburbs

Kaitlyn Foti Patch Staff. Get Real Estate Tax relief.

Illinois Property Tax Hikes Influenced By Government Debt Cook County Treasurer Releases Tool To Look Up Debt On Your Property Abc7 Chicago

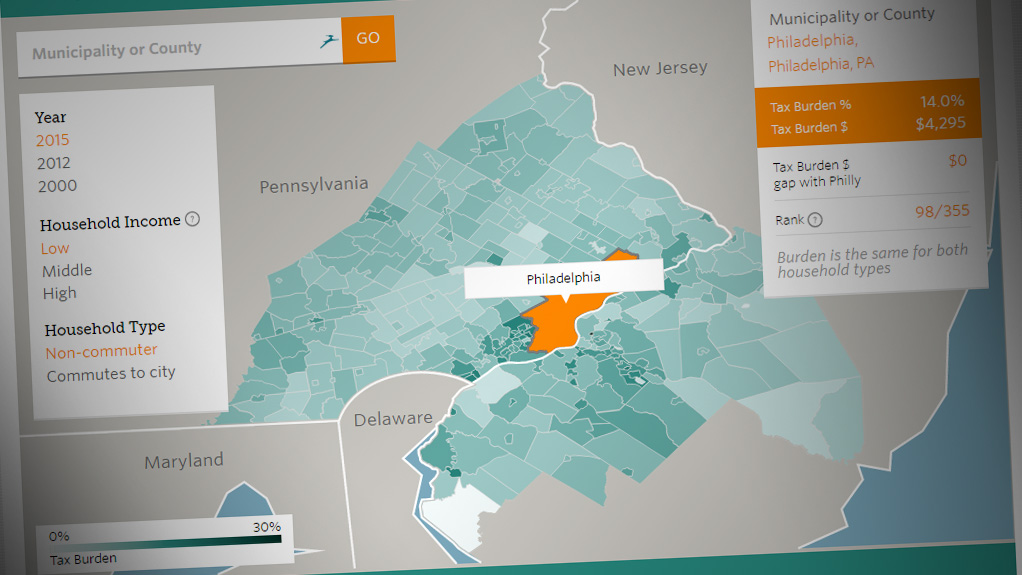

Comparing the Tax Burden in Philadelphia and the Suburbs Select a year income level and household type.

. To find detailed property tax statistics for any county in Pennsylvania click the countys name in the data table above. Download a Full Property Report with Tax Assessment Values More. I have lived here my whole life and the schools are fairly good as far as I saw and experienced.

Look up your property tax balance. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. 06317 City 07681 School District 13998 Total.

This data is based on a 5-year study of median property tax rates on owner-occupied homes in. The new system which is. The sales tax in Philadelphia is a combination of state county and city sales tax.

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. The states average effective rate is 242 of a homes value compared to the national average of 107. In fact the state carries a 150 average effective property tax rate in comparison to the 107 national average.

In 2015 it was 3924. The atmosphere is great not a whole lot of crime. If Philadelphia property tax rates have been too high for you resulting in delinquent property tax payments you may want to obtain a quick property tax loan from lenders in Philadelphia PA.

-13 In the above chart with number provided by the Office of the City Controller residents can see how Philadelphia real estate taxes compare with a select group of suburbs. For the 2022 tax year the rates are. In reality the state has an average effective property tax rate of 150 percent which is higher than the national average of 107 percent see chart below.

Then choose a municipality or county. Read more on how this ranking was calculated. According to a more exact calculation the countys average effective property tax rate is 099 percent compared to the states average effective property tax rate of 150 percent.

Get the Homestead Exemption. How Parasites Poison Nyc Suburbs Property Tax System The Accuracy And Fairness Of Philadelphia S Property Assessments Office Of The Controller. Pennsylvania is ranked 1120th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Effective property tax rates on a county basis range from 091 to 246. Get a property tax abatement. Compare Tax Burdens in the Philly Region.

The gap between the average. Philadelphia County is located in Pennsylvania. Tax bills in the suburbs falling income tax rates in Philadelphia and lower property assessments relative to home values in Philadelphia during the period.

Rating 391 out of 5. The combined percentage is 32275040 percent. It also boasts the third-lowest average property tax rates in the state according to the Tax Foundation.

Philadelphia Property Tax Rate. The median property tax also known as real estate tax in Philadelphia County is 123600 per year based on a median home value of 13520000 and a median effective property tax rate of 091 of property value. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

Lets say four area comparable houses sold for 1M recently but the disputed property with 100K in wind damage now has a 900K adjusted valuation. In general Pennsylvanias property tax rates are higher than the national average according to the Tax Foundation. Active Duty Tax Credit.

Census FBI and other data sources. Enroll in the Real Estate Tax deferral program. The Swedesboro-Logan township area is a great place to live.

So a property with an assessed value of 500000 would owe 796950 in property taxes One thing to note is that while Philadephias property tax is 8264 mills the assessed values of most properties is much lower than the actual market value so property tax amounts are generally lower. The combined Philadelphia sales tax rate is 8 which includes the 6 state tax and the 2 Delaware County sales tax. A suburb or suburban area or suburbia is a commercial mixed-use or residential area.

Report a change to lot lines for your property taxes. Its Fast Easy. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country.

This tax rate goes down a bit every year. If Philadelphia County property tax rates have been too high for you and now you have delinquent property tax payments you may want to obtain a quick property tax loan from lenders in. Washington has a 65 statewide sales tax.

Play around with making a report of your own but note. Philadelphias property tax system will change in 2013 if City Council and the mayor follow through with proposed reforms. After completeing your selections search for a town or county above or click on a town in the map below.

Explore the best suburbs to buy a house based on home values property taxes home ownership rates housing costs and real estate trends. 3 Suburbs with the Lowest Cost of Living in Philadelphia Area. Rochester NY has a few different taxes that people must pay including city school county and water.

Current taxes in Philadelphia compared to some local suburbs and how that could change with the Actual Value Initiative. The lender formerly known as the Federal National Mortgage Association. If you live in a Main Line suburb South Jersey or Bucks County and your employer is in Philadelphia you will owe Philadelphia 3465.

The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the. Overall Pennsylvania has property tax rates that are higher than national averages. The rate is on 11000 of a dollar.

The reassessment of Philadelphias 580000 properties is expected to generate 92 million in additional property revenue for the city with the value of the average residential property up 31 from the last assessment. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. Ranking based on data from the US.

Lawmakers are still hammering out the details to offset the proposed rates. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. The city taxes are 06206 percent school tax is 13939 percent county is 107898862 and water is 1340178.

They work in a separate area such as within city limits or special purpose units including recreation parks water treatment plants and fire districts.

Median Effective Property Tax Rates In Delaware Valley Region By Download Table

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Philadelphia S Ranking For Property Tax Rate Philadelphia Business Journal

2022 Best Philadelphia Area Suburbs To Buy A House Niche

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Philadelphia Suburbs Look To Avoid Becoming The Next Ferguson Al Jazeera America

Real Estate Market Update Philly And Suburbs Philly Home Girls

Interactive Map Shows Tax Burden On Lansdale Montgomeryville Pa Patch

Nj Or Pa Philadelphia Suburbs The First Time Homeowners Dilemma

Philadelphia Rent Jumped 6 During The Pandemic Suburbs Up 12 To 15 On Top Of Philly News

Nj Or Pa Philadelphia Suburbs The First Time Homeowners Dilemma

/cloudfront-us-east-1.images.arcpublishing.com/pmn/SK6XMAEIOJGBDMV3ZQKBHE64PU.jpg)

Philadelphia Property Assessments For 2023 Tax Year What To Know

Pennsylvania Property Tax Calculator Smartasset

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts